WHY HAVE TAXES IN UAE?

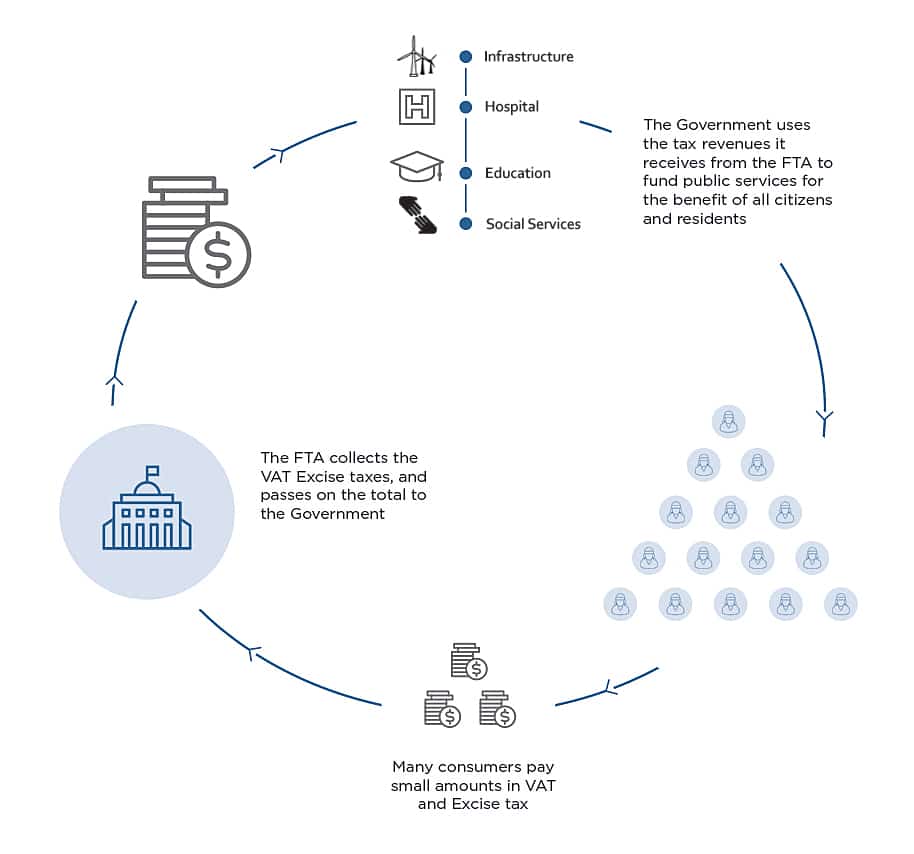

The introduction of taxes in the UAE is part of a GCC-wide initiative to diversify regional economies. Given the overall reduction in oil prices in recent years, it has been necessary for the GCC member states to explore other revenue raising measures and reduce dependency on hydrocarbons as the key contributor to the public purse. As a result, the GCC member states have agreed to sign unified framework agreements for the implementation of VAT and Excise taxes. Member states will also implement their own domestic legislation that will govern the introduction of these taxes.

The UAE’s citizens and residents enjoy exceptional public services, such as healthcare, roads, education, parks, social services and waste management. The full cost of these services is paid for by the government . The introduction of VAT and Excise taxes will help the UAE diversify sources of revenue so that government departments can continue to deliver excellent public services and ensure a high quality of life for coming generations. This is also in line with a key pillar of the UAE’s Vision 2021 – The Sustainability of Infrastructure – more information about which can be found here.

In addition, taxation allows governments to correct certain behaviours that are detrimental to society and which cannot be left to the market to regulate. Excise taxes on products that are harmful to human health are a good example of this.

EXPLAINING VAT

Value Added Tax (VAT) is an indirect tax. It is a type of general consumption tax that is collected incrementally, based on the value added, at each stage of production or distribution/sales. It is usually implemented as a destination-based tax. It is also known as goods and services tax (GST) in some countries.

VAT, a general consumption tax, will apply to most transactions in goods and services. There are only a few items exempted from VAT in the UAE. A couple of items are zero rated and the rest of the items are full rated or standard rated. The criteria for VAT registration will be on the annual turnover of the business entity. The government has tentatively decided to introduce VAT in the UAE by 01 January 2018. The proposed rate of VAT in the UAE is 5%.

Input VAT

Input VAT is the value added tax added to the price when goods are purchased or services are rendered. If the buyer is registered in the VAT Register, the buyer can deduct the amount of VAT paid from his/her settlement with the tax authorities.

Output VAT

Output VAT is the value added tax calculated and charged on the sales of goods and services.

Exempt Supply

An exempt supply is a supply on which VAT is not charged and for which the related input VAT is not deductible.

For example: bare land, local transport, the sale of residential property (second sale onwards) and lease of the residential property.

Zero rated supply

A zero-rated supply is a taxable supply on which VAT is charged at 0% and for which the related input VAT is deductible.

For example exports, healthcare, education, international transport of passengers and goods, the first sale of residential property, medicine, and medical equipment, investment in gold, silver and platinum etc.

Standard Rate Supply

A taxable supply at the Standard Rate is a supply on which VAT is charged at 5% and for which the related input VAT is deductible. All items which are not coming under both exempted category, as well as zero-rated category, are coming under standard rated supplies.

Reverse charge mechanism under UAE VAT

In the UAE VAT, the Reverse Charge Mechanism is applicable while importing goods or services from outside the GCC countries. Under this, the businesses will not have to physically pay VAT at the point of import.

The responsibility for reporting of a VAT transaction is shifted from the seller to the buyer; under Reverse Charge Mechanism. Here the buyer reports the Input VAT (VAT on purchases) as well as the output VAT (VAT on sales) in their VAT return for the same quarter.

The reverse charge is the amount of VAT one would have paid on that goods or services if one had bought it in the UAE. The importer has to disclose the amount of VAT under both Input VAT as well as Output VAT categories of the VAT return of that quarter.

Reverse Charge Mechanism eliminates the obligation for the overseas seller to register for VAT in the UAE.

VAT REGISTRATION REQUIREMENTS

Registration Requirements

• Every taxable person resident of a member state whose value of annual supplies in the member state exceeds or is expected to exceed the mandatory registration threshold

• The threshold for registration will be:

– Mandatory registration threshold: AED 375,000

– Voluntary registration threshold: at least AED 187,500

• Threshold will be calculated as follows:

– Total value of supplies made by a taxable person for the previous 12 months; or

– Total value of supplies of the subsequent 30 days

– Value of exempted supplies will not be considered for computing the annual supplies

VAT REGISTRATION REQUIREMENTS

How to Register for VAT?

Where an entity is required to register for VAT, or would like to voluntarily register for VAT, it should complete a VAT registration form

The VAT registration form will be available via the FTA’s online portal

Registrations are expected to open on a voluntarily basis during Q3 2017 and on a compulsory basis during Q4 2017 in order that registrations can be processed in good time for the implementation of VAT on 1 January 2018

During the application process, various documents will be requested to validate the information provided. It is advisable to have these to hand prior to starting the application and copies of the documents should be uploaded with the application.

Supporting documents will include such items as:

Documents identifying the authorized signatory e.g. passport copy, Emirates ID Trade license

Other official documents authorizing the entity to conduct activities within the UAE

Following approval of the application a Tax Registration Number will be issued.

WE ARE HERE TO HELP YOU GET REGISTERED SMOOTHLY WITHOUT ANY INTERRUPTIONS

VAT REGISTRATION REQUIREMENTS

VAT REGISTRATION FORM

Simple process – approximately 15 minutes to complete the form

The form should be completed by a person who is an authorized signatory of the business e.g. a Director, owner, someone holding Power of Attorney to sign on behalf of the business etc.

Prior to completing the form ensure you have considered the following:

Are you required to register for VAT or are you registering voluntarily?

Are you applying for a single VAT registration or for registration as a VAT Group?

Have supporting documentation & information on hand to upload e.g. trade license, certificate of incorporation, Emirates ID, Articles of Association, bank account details etc.

The VAT registration form will also ask you to provide details about your business, such as:

Description of business activities

Last 12 months turnover figures

Projected future turnover figures

Expected values of imports and exports

Whether you expect to deal with GCC suppliers or customers

Details of Customs Authority registration, if applicable

FTA GENERAL VAT RULES AND GETTING READY FOR VAT

To fully comply with the UAE VAT law, businesses may need to make some changes to their core operations, financial management and book-keeping, technology, and perhaps even their human resources.

It is essential that businesses try to understand the implications of the new taxes and make every effort to align their business model to government reporting and compliance requirements.

In the UAE, VAT will be levied at a rate of 5% on most goods and services, although there will be some exceptions.

End-consumers generally bear the VAT cost in the form of a 5% increase of most goods and services they purchase in the UAE, while VAT registered businesses collect and account for the tax, in a way acting as a tax collector on behalf of the government.

VAT WILL BE CHARGED AT 0% on the following:

- Exports of goods and services to outside the GCC States that implement VAT

- International transportation, and related supplies

- Supplies of certain sea, air and land means of transportation (such as aircrafts and ships)

- Certain investment grade precious metals (e.g. gold, silver, of 99% purity)

- Newly constructed residential properties, that are supplied for the first time within 3 years of their construction

- Supply of certain education services, and supply of relevant goods and services

- Supply of certain Healthcare services, and supply of relevant goods and services

Following will be exempt from VAT TAX:

- The supply of some financial services

- Residential properties

- Bare land

- Local passenger transport

FREQUENTLY ASKED QUESTIONS

GENERAL VAT QUESTIONS

Value Added Tax (or VAT) is an indirect tax. Occasionally you might also see it referred to as a type of general consumption tax. In a country which has a VAT, it is imposed on most supplies of goods and services that are bought and sold.

VAT is one of the most common types of consumption tax found around the world. Over 150 countries have implemented VAT (or its equivalent, Goods and Services Tax), including all 29 European Union (EU) members, Canada, New Zealand, Australia, Singapore and Malaysia.

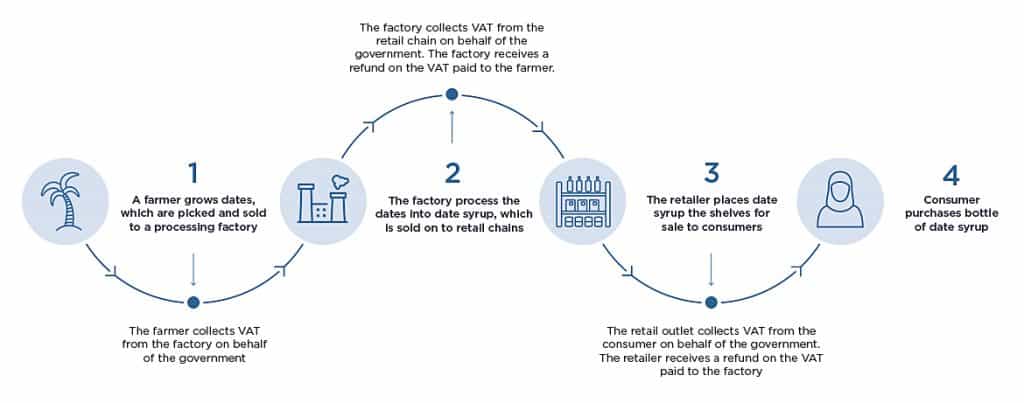

VAT is charged at each step of the ‘supply chain’. Ultimate consumers generally bear the VAT cost while Businesses collect and account for the tax, in a way acting as a tax collector on behalf of the government.

A business pays the government the tax that it collects from the customers while it may also receive a refund from the government on tax that it has paid to its suppliers. The net result is that tax receipts to government reflect the ‘value add’ throughout the supply chain. To explain how VAT works we have provided a simple, illustrative example below (based on a VAT rate of 5%):

A sales tax is also a consumption tax, just like VAT. For the general public there may be no observable difference between how the two types of taxes work, but there are some key differences. In many countries, sales taxes are only imposed on transactions involving goods. In addition, sales tax is only imposed on the final sale to the consumer. This contrasts with VAT which is imposed on goods and services and is charged throughout the supply chain, including on the final sale. VAT is also imposed on imports of goods and services so as to ensure that a level playing field is maintained for domestic providers of those same goods and services.

Many countries prefer a VAT over sales taxes for a range of reasons. Importantly, VAT is considered a more sophisticated approach to taxation as it makes businesses serve as tax collectors on behalf of the government and cuts down on misreporting and tax evasion.

The UAE Federal and Emirate governments provide citizens and residents with many different public services – including hospitals, roads, public schools, parks, waste control, and police services. These services are paid for from the government budgets. VAT will provide our country with a new source of income which will contribute to the continued provision of high quality public services into the future. It will also help government move towards its vision of reducing dependence on oil and other hydrocarbons as a source of revenue.

The UAE is part of a group of countries which are closely connected through “The Economic Agreement Between the GCC States” and “The GCC Customs Union”. The GCC group of nations have historically worked together in designing and implementing new public policies as we recognize that such a collaborative approach is best for the region.

VAT will be introduced across the UAE on 1 January 2018 at a standard rate of 5%.

Businesses will be responsible for carefully documenting their business income and costs and associated VAT charges. Registered businesses and traders will charge VAT to all of their customers at the prevailing rate and incur VAT on goods / services that they buy from suppliers. The difference between these sums is reclaimed or paid to the government.

VAT, as a general consumption tax, will apply to the majority of transactions of goods and services unless specifically exempted or excepted by law.

The cost of living is likely to increase slightly, but this will vary depending on the individual’s lifestyle and spending behaviour. If your spending is mainly on those things which are relieved from VAT, you are unlikely to see any significant increase.

VAT is intended to help improve the economic base of the country. Therefore, we will include rules that require businesses to be clear about how much VAT you are paying for each transaction. You will have the required information to decide whether to buy something or not.

Any person will be able to object a decision of the Federal Tax Authority.

As a first step, the person shall request the FTA to reconsider its decision. Such request of re-consideration has to be made within 20 business days from the date the person was notified of the original decision of the FTA, and the FTA will have 20 business days from receipt of such application to provide its revised decision.

If the person is not satisfied with the revised decision of the FTA, it will be able to object to the Tax Disputes Resolution Committee which will be set up for these purposes. Objections to the Committee will need to be submitted within 20 business days from the date the person was notified of the FTA’s revised decision, and the person must pay all taxes and penalties subject of objection before objecting to the Committee. The Committee will typically be required to give its decision regarding the objection within 20 business days from its receipt.

As a final step, if the person is not satisfied with the decision of the Committee, the person may challenge its decision before the competent court. The appeal must be made within 20 business days from the date of the appellant being notified of the Committee’s decision

VAT FOR TOURISTS AND VISITORS

Yes, tourists are a significant source of revenue for the UAE and will pay VAT at the point of sale. Nevertheless, we have set the VAT rate deliberately low so that VAT is a limited burden on all consumers.

It is intended that we will allow foreign businesses to recover the VAT they incur when visiting the UAE. This is important as it encourages them to do business and also, because a lot of other countries have VAT systems, it protects the ability of UAE businesses to recover VAT when visiting other countries (where the rates are a lot higher).

OTHER RELATED QUESTIONS

Tax is the means by which governments raise revenue to pay for public services. Government revenues from taxation are generally used to pay for things such public hospitals, schools and universities, defence and other important aspects of daily life.

There are many different types of taxes:

- A direct tax is collected by government from the person on whom it is imposed (e.g., income tax, corporate tax).

- An indirect tax is collected for government by an intermediary (e.g. a retail store) from the person that ultimately pays the tax (e.g., VAT, Sales Tax).

As per global best practice, the UAE is exploring other tax options as well. However, these are still being analysed and it is unlikely that they will be introduced in the near future. The UAE is not currently considering personal income taxes, however.

Our analysis suggests that it will help the country strengthen its economy by diversifying revenues away from oil and will allow us to fund many public services. This is a sign of a maturing economy.

The government has launched an awareness and education campaigns to educate UAE residents, businesses, and other impacted groups. Our aim is to help everyone understand what VAT is, how it works, and what businesses will need to do to comply with the law.

As part of its awareness campaign, the Ministry of Finance has launched the first phase of the awareness sessions during the period from March till May 2017. These sessions were held in the different Emirates.

We will also set up a website where you can find information to understand the new tax in detail.

A telephone hotline by FTA has been set up so that you can call and speak to one of our employees directly on 600599994.

AND YOU CAN CONTACT US AT 024443248 or 0544468407 for Free Assistance.

When VAT is introduced, the government will provide information and education to businesses to help them make the transition. The government will not pay for businesses to buy new technologies or hire tax specialists and accountants. That is the responsibility of each business. We will, however, provide guidance and information to assist you and we are giving businesses time to prepare.

Everyone is urged to fully comply with their VAT responsibilities. The government is currently in the process of defining the exact fees and penalties for non-compliance.

Administrative penalties for violations will be decided by Cabinet and announced after issuance. There will be further penalties decided by Courts in the case of tax evasion.

VAT FOR BUSINESSES

A business must register for VAT if their taxable supplies and imports exceed the mandatory registration threshold of AED 375,000.

Furthermore, a business may choose to register for VAT voluntarily if their supplies and imports are less than the mandatory registration threshold, but exceed the voluntary registration threshold of AED 187,500.

Similarly, a business may register voluntarily if their expenses exceed the voluntary registration threshold. This latter opportunity to register voluntarily is designed to enable start-up businesses with no turnover to register for VAT.

All businesses in the UAE will need to record their financial transactions and ensure that their financial records are accurate and up to date. Businesses that meet the minimum annual turnover requirement (as evidenced by their financial records) will be required to register for VAT. Businesses that do not think that they should be VAT registered should maintain their financial records in any event, in case we need to establish whether they should be registered.

VAT-registered businesses generally:

- must charge VAT on taxable goods or services they supply;

- may reclaim any VAT they’ve paid on business-related goods or services;

- keep a range of business records which will allow the government to check that they have got things right

If you’re a VAT-registered business you must report the amount of VAT you’ve charged and the amount of VAT you’ve paid to the government on a regular basis. It will be a formal submission and it is likely that the reporting will be made online.

If you’ve charged more VAT than you’ve paid, you have to pay the difference to the government. If you’ve paid more VAT than you’ve charged, you can reclaim the difference.

oncerned businesses will have time to prepare before VAT will come into effect in January 2018. During that time, businesses will need to meet requirements to fulfil their tax obligations. Businesses could start now so that they will be ready later. To fully comply with VAT, We believe that businesses may need to make some changes to their core operations, their financial management and book-keeping, their technology, and perhaps even their human resource mix (e.g., accountants and tax advisors). It is essential that businesses try to understand the implications of VAT now and once the legislation is issued make every effort to align their business model to government reporting and compliance requirements. We will provide businesses with guidance on how to fully comply with VAT once the legislation is issued. The final responsibility and accountability to comply with law is on the business.

VAT will come into force on 1 January 2018. Any business that is required to be registered for VAT and charge VAT from 1 January 2018 must be registered prior to that date.

To enable businesses to prepare for introduction of VAT and comply with this registration obligation in time, the electronic registrations will be open for VAT from the third quarter of 2017 on a voluntary basis and a compulsory basis from the final quarter of 2017 for those that choose not to register earlier. This will ensure that there is no last minute rush from businesses to register for VAT before the deadline.

Taxpayers must file VAT returns with the FTA on a regular basis (quarterly or for a shorter period, should the FTA decide so) within 28 days from the end of the tax period in accordance with the procedures specified in the VAT legislation. The Tax returns shall be filed online using eServices.

Businesses will be required to keep records which will enable the Federal Tax Authority to identify the details of the business activities and review transactions. The specifics regarding the documents which will be required and the time period for keeping them will be stated in the relevant legislation.

Any taxable person must retain VAT invoices issued and received for a minimum of 5 years.

The place of supply will determine whether a supply is made within the UAE (in which case the UAE VAT law will apply), or outside the UAE for VAT purposes.

For a supply of goods, the place of supply should be the location of goods when the supply takes place with special rules for certain categories of supplies (e.g. water and energy, cross border supplies).

For the supply of services, the place of supply should be where the supplier is established with special rules for certain categories of supplies (e.g. cross border supplies between businesses).

VAT shall be payable in addition to the customs duties paid by the importer of the goods and cannot be deducted. VAT shall be computed on the value that includes the customs duties.

The VAT treatment of real estate will depend on whether it is a commercial or residential property.

Supplies (including sales or leases) of commercial properties will be taxable at the standard VAT rate (i.e 5%).

On the other hand, supplies of residential properties will generally be exempt from VAT. This will ensure that VAT would not constitute an irrecoverable cost to persons who buy their own properties. In order to ensure that real estate developers can recover VAT on construction of residential properties, the first supply of residential properties within 3 years from their completion will be zero-rated.

VAT will be charged at 0% in respect of the following main categories of supplies:

- Exports of goods and services to outside the GCC;

- International transportation, and related supplies;

- Supplies of certain sea, air and land means of transportation (such as aircrafts and ships);

- Certain investment grade precious metals (e.g. gold, silver, of 99% purity);

- Newly constructed residential properties, that are supplied for the first time within 3 years of their construction;

- Supply of certain education services, and supply of relevant goods and services;

- Supply of certain Healthcare services, and supply of relevant goods and services.

The following categories of supplies will be exempt from VAT:

- The supply of some financial services (clarified in VAT legislation);

- Residential properties;

- Bare land; and

- Local passenger transport

Businesses that satisfy certain requirements covered under the Legislation (such as being resident in the UAE and being related/associated parties) will be able to register as a VAT group. For some businesses, VAT grouping will be a useful tool that would simplify accounting for VAT.

VAT registered businesses will be able to reduce their output tax liability by the amount of VAT that relates to bad debt which has been written off by the VAT registered business. The legislation will include the conditions and limitations concerning the use of this relief.

To avoid double taxation where second hand goods are acquired by a registered person from an unregistered person for the purpose of resale, the VAT-registered person will be able to account for VAT on sales of second hand goods with reference to the difference between the purchase price of the goods and the selling price of the goods (that is, the profit margin). The VAT which must be accounted for by the registered person will be included in the profit margin. The legislation will include the details of the conditions to be met in order to apply this mechanism.

Where a VAT registered person incurs input tax on its business expenses, this input tax can be recovered in full if it relates to a taxable supply made, or intended to be made, by the registered person. In contrast, where the expense relates to a non-taxable supply (e.g. exempt supplies), the registered person may not recover the input tax paid.

In certain situations, an expense may relate to both taxable and non-taxable supplies made by the registered person (such as activities of the banking sector). In these circumstances, the registered person would need to apportion input tax between the taxable and non-taxable (exempt) supplies.

Businesses will be expected to use input tax (ratio of recoverable to total) as a basis for apportionment in the first instance although there will be the facility to use other methods where they are fair and agreed with the Federal Tax Authority.

Penalties will be imposed for non-compliance.

Examples of actions and omissions that may give raise to penalties include:

- A person failing to register when required to do so;

- A person failing to submit a tax return or make a payment within the required period;

- A person failing to keep the records required under the issued tax legislation;

- Tax evasion offences where a person performs a deliberate act or omission with the intention of violating the provisions of the issued tax legislation.

No special rules are planned for small or medium sized enterprises. However, the FTA will provide materials and resources available for these entities to assist them in their enquiries.

Special rules will be provided to deal with various situations that may arise in respect of supplies that span the introduction of VAT. For example:

- Where a payment is received in respect of a supply of goods before the introduction of VAT but the goods are actually delivered after the introduction of VAT, this means that VAT will have to be charged on such supplies. Likewise, special rules will apply with regards to supplies of services spanning the introduction of VAT.

- Where a contract is concluded prior to the introduction of VAT in respect of a supply which is wholly or partly made after the introduction of VAT, and the contract does not contain clauses relating to the VAT treatment of the supply, then consideration for the supply will be treated as inclusive of VAT. There will, however, be special provisions to allow suppliers to charge VAT in situations where their recipient is able to recover their VAT but where there is no VAT clause.

Generally, insurance (vehicle, medical, etc) will be taxable. Life insurance, however, will be treated as an exempt financial service.

It is expected that fee based financial services will be taxed but margin based products are likely to be exempt.

Islamic finance products are consistent with the principles of sharia and therefore often operate differently from financial products that are common internationally.

To ensure that there are no inconsistencies between the VAT treatment of standard financial services and Islamic finance products, the treatment of Islamic finance products will be aligned with the treatment of similar standard financial services.

A scheme will be introduced to allow a UAE national who is not registered for VAT to reclaim VAT paid on goods and services relating to constructing a new residence which will be privately used by the person and his family. This will allow the recovery of VAT on such expenses as contractor’s services and building materials.

Refunds will be made after the receipt of the application and subject to verification checks, with a particular focus on avoiding fraud.

In the course of its interaction with taxpayers, the FTA may provide its views on various matters in the law. Taxpayers may choose to challenge these views. It should be noted that penalties may be imposed on taxpayers who are found to violate any tax laws and regulations.

A supplier registered or required to be registered for VAT must issue a valid VAT invoice for the supply. To be considered as a valid VAT invoice, the document must follow a specific format as mentioned in the legislation. In certain situations the supplier may be able to issue a simplified VAT invoice. The conditions for the VAT invoice and the simplified VAT invoice are mentioned legislation.

VAT will not be deductible in respect of expenses incurred for making non-taxable supplies. Furthermore, input tax cannot be deducted if it is incurred in respect of specific expenses such as entertainment expenses e.g. employee entertainment.

VAT on expenses that were incurred by a business can be deducted in the following circumstances:

- The business must be a taxable person (the end consumer cannot claim any input tax refund).

- VAT should have been charged correctly (i.e. unduly charged VAT is not recoverable).

- The business must hold documentation showing the VAT paid (e.g. valid tax invoice).

- The goods or services acquired are used or intended to be used for making taxable supplies.

- VAT input tax refund can be claimed only on the amount paid or intended to be paid before the expiration of 6 months after the agreed date for the payment of the supply.

Non-residents that make taxable supplies in the UAE will be required to register for VAT unless there is any other UAE resident person who is responsible for accounting for VAT on these supplies. This exclusion may apply, for example, where a UAE business is required to account for VAT under a reverse charge mechanism in respect of a purchase from a non-resident.

VAT is due on the goods and services purchased from abroad.

In case the recipient in the State is a registered person with the Federal Tax Authority for VAT purposes, VAT would be due on that import using a reverse charge mechanism.

In case the recipient in the State is a non-registered person for VAT purposes, VAT would be paid on import of goods from a place outside the GCC. Such VAT will typically be required to be paid before the goods are released to the person.

Supplies made by government entities will typically be subject to VAT. This will ensure that government entities are not unfairly advantaged as compared to private businesses.

Certain supplies made by government entities will, however, be excluded from the scope of VAT if they are not in competition with the private sector or where the entity is the sole provider of such supplies. It is likely certain government entities will be entitled to VAT refunds – this is designed to avoid budgeting issues and provide a level playing field between outsourced and insourced activities.

For the supplies provided for government entities, the treatment of such supplies shall depend on the same supply and not on the recipient of the supply. Therefore, if the supply is subject to the standard tax rate, the treatment would remain the same even if it is provided to a government entity.

It is expected that businesses will need to complete additional information on their VAT returns to report revenues earned in each Emirate. Guidance will be provided to businesses with regards to this.

It is expected that the rules will be relatively straightforward for most businesses and will be based, for example, for B2C transactions, on the location of the transaction (e.g. in a retail environment, the location of the shop).

Not necessarily. Some goods that are imported may be exempt from customs duties but subject to VAT.

“We have highly qualified Tax professionals who have hands-on tax planning and implementation experience from various countries. So come join us and we will help your business smoothly infuse into the current taxation system.